A growing number of lenders have been raising interest rates over the past week in response to rising bond yields, including RBC, BMO and National Bank of Canada.

Last week, BMO raised its insured 5-year fixed rate by 20 basis points, bringing it to 2.19%, and hiked its uninsured 5-year fixed by 10 bps to 2.39%. It also raised its special-offer 3-year fixed by 10 bps.

RBC reversed previous rate cuts announced last month by increasing its 5-year fixed rates by 25 bps to 2.44%.

National Bank of Canada was another Big 6 bank to increase rates, bumping its 5-year fixed rates by 5 bps to 2.29%.

Other lenders that have hiked rates over the past week include Desjardins, Simplii Financial, Investors Group and Canada Life, as well as numerous brokers and brokerages. Most rate increases have so far been modest, at between 5 and 15 bps.

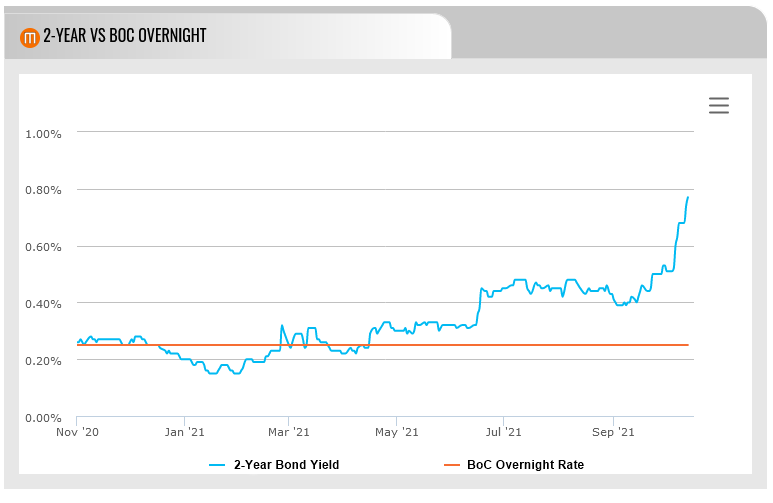

These mortgage rate increases have been taking place against the backdrop of soaring bond yields, which generally lead fixed mortgage rates. Not to mention above-target inflation, labour shortages and supply/demand imbalances.

The Government of Canada 5-year bond yield closed above 1.24% on Tuesday and continued to climb above 1.27% by Wednesday morning, the highest it’s been since February 2020.

Meanwhile, Canada’s 2-year bond yield soared to its highest level since March 2020, closing above 0.73% and surpassing 0.77% on Wednesday.

This is also more than 38 basis points above the U.S. 2-year yield, marking the widest spread since early 2015.

Nobody knows where rates will go from here. They could very well take another tumble, as they did following the rate increases in early 2021. But they could also continue to rise, according to rate expert Rob McLister.

“…fixed mortgage rates could easily approach their highs of last year before too long,” he wrote in a recent Globe and Mail column. “That could take them up at least 50 basis points (one-half of a percentage point) by 2022, compared with today.”

On an average $300,000 mortgage, that could mean an extra $1,400 in interest per year, or $7,000 for a 5-year term, he noted.

(Updated Oct. 13, 2021)

Mortgage Rate Forecasts

Speaking of mortgage rate forecasts, the British Columbia Real Estate Associate (BCREA) recently released its latest rate outlook.

“We expect fixed rates to gradually rise back to pre-pandemic levels while variable rates follow the Bank of Canada’s timetable,” the report reads. “That means a fixed 5-year rate of 2.1% for the remainder of this year, along with a 1.5% variable rate available through 2022.”

Looking further out, BREA sees average discounted 5-year fixed rates trending upwards to 2.25% by the first half of 2022 and 2.50% by the end of 2022.

It also sees prime rate rising by 25 basis points to 2.70% in the fourth quarter of 2022, and the 5-year qualifying rate holding steady at 5.25% through the next year.

“We expect the Bank of Canada will proceed with caution, especially given the fourth wave of COVID-19” and an unexpected contraction of GDP in the second quarter, noted BREA’s chief economist Brendon Ogmundson. “That likely means a new timeline for the Bank of Canada to raise its policy rate with the earlier increase coming in mid-2023.”

Ontario Needs 1 Million New Homes

In order to meet homebuyer demand, an estimated 1 million homes need to be built in Ontario over the next decade, according to a new report by the Smart Prosperity Institute.

Currently, about 70,000 housing units are brought to the market in a typical year, meaning that will need to increase to at least 100,000 units, according to Mike Moffatt, senior director of policy at the Smart Institute and the study’s author.

“This estimate of one million additional households should be taken as what could be expected in the absence of policy changes,” Moffatt wrote, noting that the actual total number of new households created will depend on policy decisions, such as immigration policy, labour policy, rules governing international students and housing policy.

Ontario’s population grew by over 600,000 between 2016 and 2021, which put significant pressure on housing demand, the report noted. Due to high demand, low supply and rising prices, a number of young couples looking to start families who wanted to find family-friendly housing instead had to find alternative arrangements, such as living with parents.

“Adding together the unformed households from 2016–21 due to the supply gap of homes, along with the formation of new households, we project, on net, an additional one million households to be formed in the next 10 years,” the report reads.

The population is expected to grow another 2.27 million people between 2021 and 2031.

Published by Steve Huebl