NATIONAL HOUSING MARKET RISK: HIGH!

High home prices and buyer expectations of continued price growth have put the country’s housing market at increased risk of a correction, Canada’s housing agency said on Tuesday.

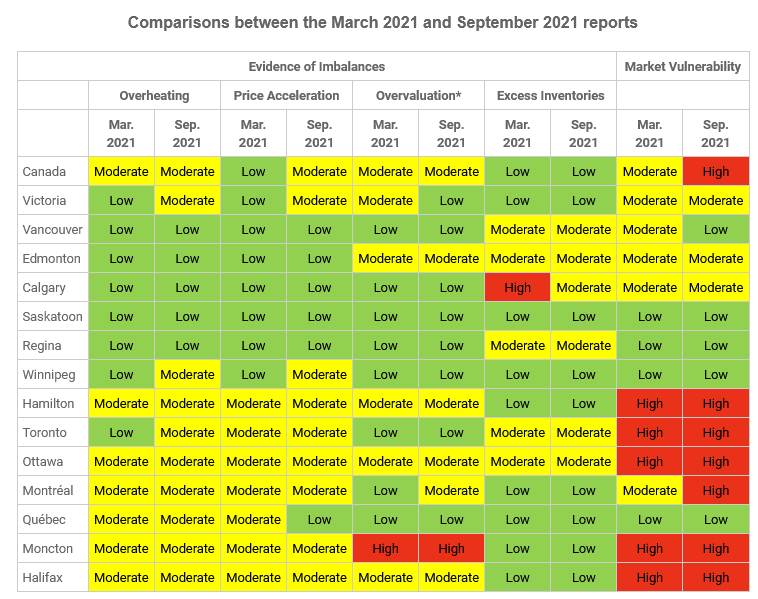

The Canada Mortgage and Housing Corporation (CMHC) raised its national risk level to high from moderate in its third-quarter Housing Market Assessment report.

This is the second time the national risk level has been raised to high. Prior to May 2019, the indicator had flagged the country’s housing market vulnerability as “high” for preceding 10 straight quarters.

“Exceptionally strong demand and home price appreciation through the course of the pandemic may have contributed to increased expectations of continued price growth for homebuyers in several local housing markets across Ontario and Eastern Canada,” Bob Dugan, CMHC’s chief economist, said in a release. “This, in turn, may have caused more buyers to enter the market than was warranted.”

Improved housing fundamentals in the first half of the year, such as historically low interest rates, government support programs and the rollout of mass vaccination programs, led to an increase in purchasing power, disposable income and employment, CMHC noted. These factors, however, weren’t enough to justify the rapid price growth over this period.

The housing agency said the high vulnerability at the national level was “largely a reflection of problematic conditions in several local housing markets across Ontario and Eastern Canada.” This included Montreal’s vulnerability being raised to high from moderate.

Vancouver’s market vulnerability, on the other hand, was reduced to a “low” rating following a slowdown in price growth and home sales.

CMHC’s Regional Breakdown

Six of the census metropolitan areas (CMAs) tracked by CMHC are now in the high-risk zone, up from five in the second quarter.

Here’s a brief rundown of factors impacting some of those metro areas:

- Greater Toronto Area (high): “Despite existing home sales starting to ease and the pandemic-induced buying activity dissipating during the second quarter of 2021, the demand-supply … contributed to the persistence of price acceleration.”

- Montreal (high): “…home prices have risen sharply and are well above the level warranted by fundamentals, such as labour income.”

- Ottawa (high): “…home sales have trended down since April 2021, but sellers’ market conditions still prevail as listings remain at historic lows, pressuring price growth.”

- Moncton (high): “…prices have continued to grow in 2021 (23% year-to-date) reflecting the underlying disconnect between the supply and demand for housing.”

Saskatoon, Regina, Winnipeg and Quebec continue to show a “low” degree of vulnerability in their housing markets, CMHC said.