Expectations for the first Bank of Canada interest rate hike have moved up to as early as April as inflation concerns grow and supply disruptions persist.

Nearly half of Canadian businesses (45%) expect inflation to run hot at more than 3% over the next year, according to the Bank of Canada’s third-quarter Business Outlook Survey released Monday. Another 42% of businesses expect inflation of 2-3%, while just 10% foresee inflation of between 1% and 2%.

The inflation concerns were largely driven by worsening supply disruptions that will limit sales, along with labour shortages and the need for higher wages, both of which will drive prices higher. The silver lining is that most businesses see higher inflation as being temporary.

Still, the median prediction for inflation from the business survey was 3.72%, the highest reading since the survey started in 2014.

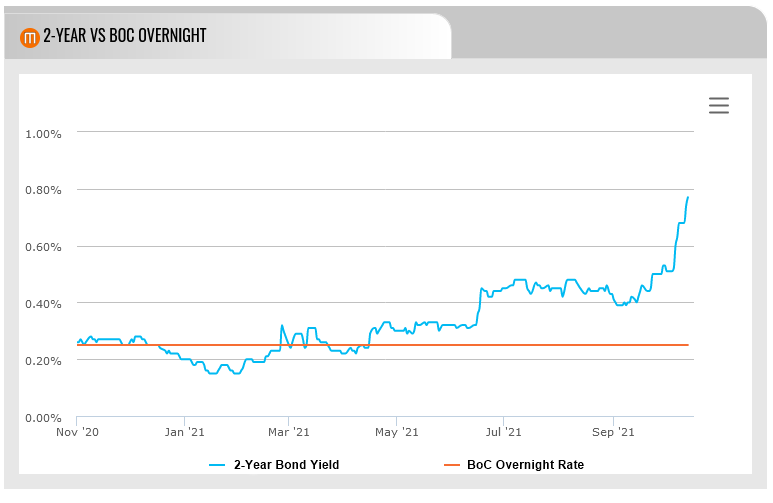

Because inflation expectations are a major driver of inflation, markets have taken notice and now see the Bank of Canada being forced to raise interest rates sooner than the second half of 2022, which has been the guidance provided by the BoC for much of the past year.

Overnight Index Swap (OIS) markets are now almost fully pricing in the first quarter-point rate hike by April, according to Bloomberg.

Other market watchers agree that rate hikes are likely to come sooner than expected. David Wolf, a portfolio manager for Fidelity Investments, says the Bank of Canada is overestimating the amount of slack in the economy and will therefore need to raise rates well before the second half of the year.

“The bank thinks that there’s a lot of capacity, which I don’t think there really is, and the facts on the ground of rising prices show that,” Wolf said at the Bloomberg Canadian Fixed Income Conference, according to the Financial Post. He added that expectations for the first rate hike in the second half of 2022 are off base.

“It’s going to come a lot sooner than that,” Wolf added.

In comparison, here’s a look at Canada’s big bank forecasts for the first rate hikes in 2022 (keep in mind that some of these estimates are lagging by several weeks):

- BMO: +25 basis points (bps) in Q4; an overnight rate of 0.50% by end of 2022

- CIBC: +25 bps in Q4; 0.50% by end of 2022

- NBC: +50 bps in Q3; 1.00% by end of 2022

- RBC: +25 bps in Q3; 0.75% by end of 2022

- Scotia: +25 bps in Q3; 0.75% by end of 2022

- TD: +25 bps in Q4; 0.50% by end of 2022.

Better to Act Early: Tal

Signs that the Bank of Canada may move earlier than expected is actually a positive development, according to CIBC’s Benjamin Tal. In the early days of the pandemic, rate hikes weren’t forecast until 2023 or even 2024.

Tal, who meets regularly to advise the BoC, said he has encouraged the Bank to “buy some insurance” by making its first rate move by early or mid-2022.

“I’m very encouraged by the fact that they are willing to move early rather than later,” Tal said during a talk at Mortgage Professionals Canada’s Virtual Mortgage Symposium last week.

He noted that waiting later than that would risk having the Bank chase a lagging indicator, which could lead to more serious economic problems.

“If you are chasing a lagging indicator, clearly you are late. And what do you do when you’re late? You panic,” Tal said. “And when you panic, you start raising interest rates way too quickly. It happened before [in] every other recession.”

Tal went on to say that he has no problem with the Bank raising rates by 75 basis points between June and December 2022. “In my opinion, that will prevent variable rates and the 5-year rate from rising dramatically in 2023,” he said.

“The best news, as far as the real estate market in Canada is concerned, is the fact that now the Bank of Canada is [considering] the idea of moving by mid-2022 and I think that’s a very good thing…it will be better for the market to see interest rates starting to rise a bit earlier because that will limit future huge increases.”

Central Banks Heading for Exits on Quantitative Easing

In addition to raising interest rates, central banks around the world are growing increasingly eager to withdraw economic stimulus in the form of Quantitative Easing (QE).

For the Bank of Canada, that means further diminishing its ongoing purchases of $2 billion worth of bonds per week.

At the height of the program, the Bank was purchasing up to $5 billion worth of bonds per week, but that amount has gradually been reduced. In total, the Bank has acquired nearly $312 billion of Government of Canada debt since last March in an effort to add liquidity to the market.

It’s widely expected that the BoC will continue to wind down its QE program at its next rate decision meeting on October 27.

Published by Steve Huebl